Send your survey

Table of contents

To send your survey plays a vital role in your survey project. You will need to decide who should receive the survey (a respondent list), through what channel, and when it should be sent. The most common distribution channel is e-mail, but there are also the options of SMS or publishing a direct link to the survey, e.g. on a webpage, social media, or your company intranet.

It is also possible to combine multiple different distribution channels for a single survey, meaning that you could generate both SMS and email sendouts whilst still receiving one aggregated result to work with.

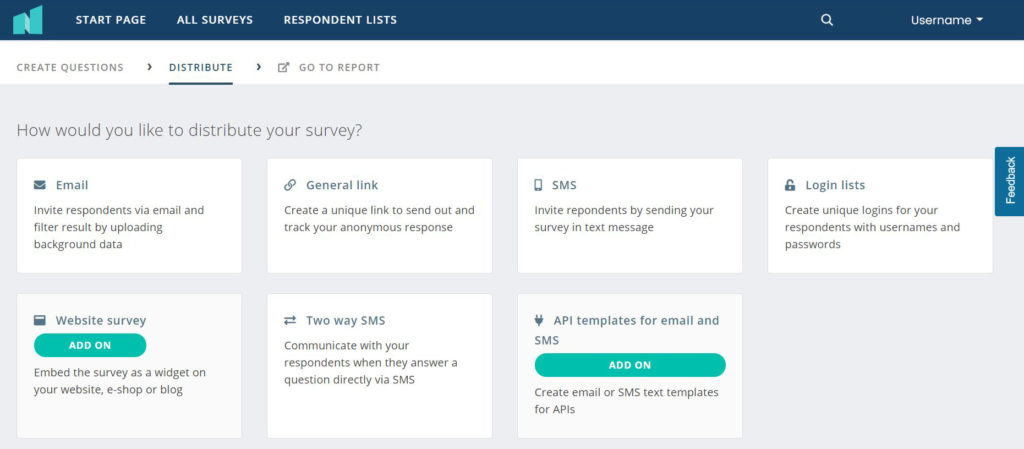

Choosing a distribution channel

When it comes to distributing your survey, it often comes down to what means you have to contact your selected respondents, and the method through which you will receive the most responses.

As noted, the most common distribution method is to send the survey directly to respondents’ e-mail addresses. This is often preferred simply because it is one of the most convenient ways to contact people.

For shorter “pulse” surveys, sending an SMS containing a link can be sufficient. It’s a quick and easy way to reach respondents and the surveys are simple enough to be quickly completed on a mobile device.

In scenarios where you do not have direct contact details for your desired respondents or do not have specific respondents in mind, you can generate a shareable survey link. This will allow you to share the survey in locations where your target group might congregate or pass through, for example, on your website or social media accounts. This means that anyone who is interested in completing the survey can do so by clicking the link and submitting their answers.

You can read more about the different distribution channels here.

It is of course possible to choose multiple sendout methods.

What to include in a sendout text?

-

What is the survey about?

Be clear when outlining the content and purpose of the survey. Try to keep this as concise as possible.

-

Why should the recipients respond to the survey?

Your response rate can increase if you incentivise your respondents to complete the survey. You can do this by defining a clear purpose for participants and explaining how vital their responses are to improving your offering.

-

How long will it take to respond?

Be honest! If you are unsure, ask some colleagues to respond to the survey and see how long it takes. If it is a short survey, you can use that as an incentive to respond and if it is a longer one, it is good to provide the recipients with plenty of motivation to respond to the whole survey.

-

How will the results of the survey help you?

Do not forget to let respondents know how important their feedback is and how it will help you to improve your product/support/service.

-

Is the survey anonymous?

If respondents will remain anonymous, be sure to tell them as this could encourage more honest answers.

-

How should the subject field be worded?

The subject field is the first thing that a respondent reads. Keep it short, easy to understand and with a clear purpose. You can also do a test by sending two e-mails with different subject fields to a small group of respondents to see if either of the emails receives a larger percentage of answers.

-

Which email address is the survey sent from?

Use an email address that the respondent will immediately recognise, otherwise you will risk having the e-mail dismissed as spam.

-

Who is the sender of the survey?

Most companies use the company name as the sender, but it can also be effective to use a specific person as the sender. You could, for example, send the survey from the product manager if the survey is about product development or from a sales representative who has had direct contact with the customer.

When is a good time to send my survey?

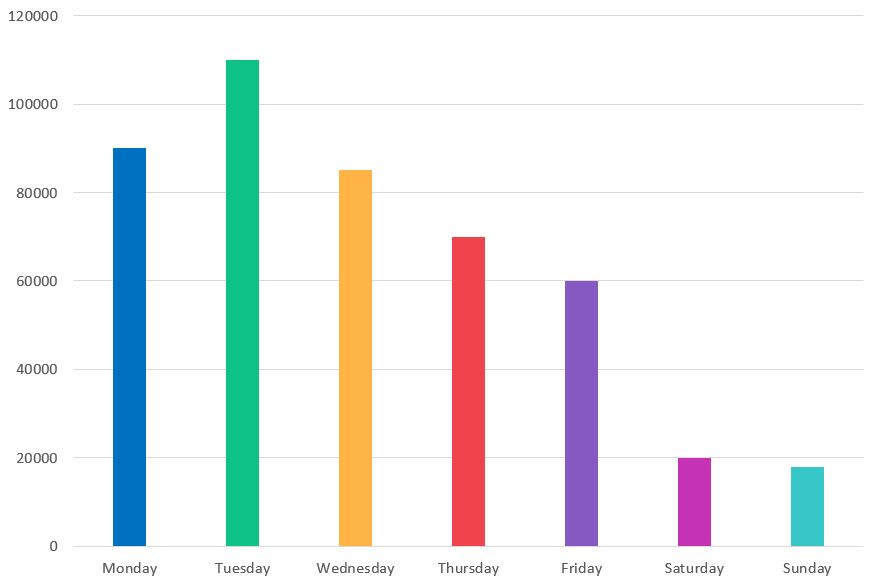

The answer to this question is not clear cut. It depends on the target group and any circumstances that may affect their ability or desire to reply, e.g. public holidays or time of day. Generally speaking, sending surveys early in the week seems to get the best response level.

This graph is based on Netigate data about the number of responses received on different days of the week:

Can you please provide more feedback so we can make this article better?